So, my winter vacation lasted longer than I had anticipated, and I was pretty out of touch with the market for the most part. I have been working my way back in for the past couple weeks, and I am finally starting back up the weekly posts on my thoughts for the market.

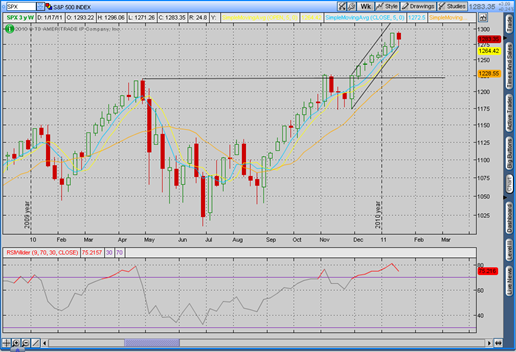

I began this thing back in late October and stopped in the middle of December. During that time I wasn’t too hesitant to share my bearish sentiments, which obviously have been completely incorrect. Hopefully I was able to present at least a little bit of a bullish argument as well, but the main idea is really to trade whatever opportunity you are presented with. Though my hesitancy may have shielded me from maximizing the bullish opportunity, I was not too stubborn to stay positioned on the short side. From medium-term perspective it is very difficult to do so anyway. Taking a look at the numbers from the beginning of December until now, the S&P is up quite a bit (+102.8, +8.71%). Looking at the weekly chart, everything seems quite bullish:

As you can see, the breakout from the 1219 level (April 2010s highs) has been sustained a appears pretty healthy. The late August to early November rally was characterized by 11 straight weeks of higher highs and higher lows. Again, for the past eight weeks this rally has continued (8 higher highs and higher lows). This chart has an RSI indicator (9 period/ 2 months) which basically relates how much the price is rising to how much the price is falling. As you can see, it has been in the overbought range since the beginning of the rally. The indicator did peak last week at around 81 (the highest it has been since the April peak). This could mean that the prices won’t be able to sustain this rapid growth, which we saw this past week as prices closed lower on the week than they opened. The growth hasn’t necessarily stopped, the buyers may have just been a little worn out, and could very well take back over this coming week.

Earnings

It’s earnings season once again, and a lot of companies who have beat the expected have drastically risen in price. I wrote about the overall strength of the Q3 earnings reports and their subsequent support in price rising in New Directions?. The Q4 reports have had some success as well. I’m going to look at a few companies that came out with earnings last week and see how it affected the price.

GE

Est: 0.319 Actual: 0.36

The talk of the market on Friday was GE who shot up 7.11% on a good earnings report, beating by .0341. Though the price seemed to be trailing off earlier this week, the good earnings caused it to gap up at the open almost a full point.

IBM

Est: 4.079 Actual: 4.18

IBM is a crucial stock for the market because it is one of the rare securities that is a component of the Dow and the S&P. Again you can see the gap up from the earnings report on Tuesday afternoon. This was a major market driver this week. Unlike GE, however, IBM was establishing a trend upwards with 5 straight days of higher lows, which continued for the 3 days following the earnings report as well.

GOOG

Est: 7.162 Actual: 8.75

Google beat estimates by quite a bit, but didn’t respond well at all (unlike GE and IBM). Looking back at the Q3 earnings announcement, you can see the huge gap up (beating estimates by a huge $1.72. This time, however after a gap up, the price dropped 14.94, –2.38%. This is a bit curious as it beat the estimates by about $1.50.

Though earnings announcements are good, the price action doesn’t always follow suit, which is why earnings are difficult to speculate, making them very dangerous to trade. Overall, however, earnings are a good barometer of the overall health of the market, but (and I can’t exactly prove this) I think many companies have a tendency (especially in rough economical situations such as our current one) to deflate their estimates so when the earnings come out, they look better than they actually are, causing some artificial inflation in the price.

Well thanks for reading, and I apologize for the delay in this report, but I hope to be more active on the blog this semester.

-Daniel Nall